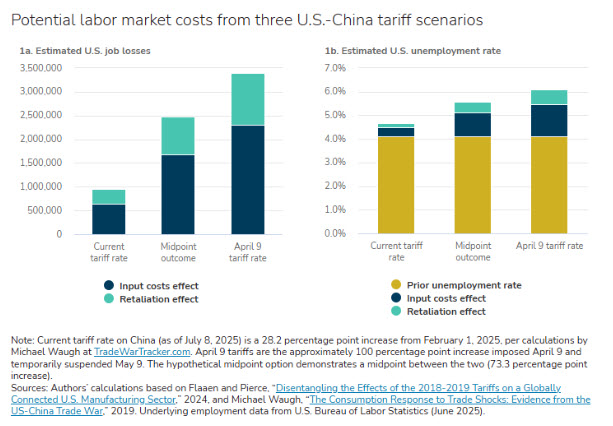

Talk about a rollercoaster. For the talent acquisition community, 2020-2023 was a chaotic blur: layoffs, remote work, hire everyone, skill-based hiring, retention (x3!), over-hiring, and then fire everyone. And let’s not forget the endless AI saga: “It’s coming…nope, not yet…wait, it’s here…maybe? No, seriously, it’s here this time and replacing some of you…” It was the professional equivalent of my pregnancy—you know, learning the exact location of every bathroom as a crash course for eventually potty-training a toddler. That stretch from 2020 to 2023 was necessary survival training, forcing us to quickly understand and adapt to massive shifts. Good thing, because the velocity of change we’re facing now would have been unthinkable five years ago. Now, we just move: walk, hop, skip, or sprint. Right now, we’re tracking seismic shifts in federal compliance, trying to function in a cloud of unclear government data, and watching AI go from zero to sixty—it’s now in every part of the process, from screening to the application itself. Like the verse of our kids’ survival song “Going on a Bear Hunt”, Can’t go under it, can’t go around it, must go through it. Let’s talk about it. The Policy & Economic FogThe ground under federal contractors is shifting dramatically with news of the Office of Federal Contract Compliance Programs (OFCCP) and the Work Opportunity Tax Credit (WOTC) facing significant changes or even elimination. The revocation of Executive Order 11246 has sharply curtailed OFCCP’s traditional affirmative action mandate, forcing Talent Acquisition (TA) leaders to rethink their compliance and diversity strategies. For those that rely on WOTC, a significant elimination of budgetary contributions to the overall recruiting budget may introduce funding challenges for TA initiatives. Compounding this is the national data blackout. With the ongoing government shutdown halting the release of key employment reports, the true picture of the US job market is obscured [3.1, 3.3]. The last official figures placed the US unemployment rate at a tight 4.3% and job openings at 7.2 million (both as of August 2025), but the lack of real-time or even slightly delayed updates leaves policymakers and recruiters flying blind at a critical moment. Furthermore, for companies with a global footprint, Trade Tariffs have injected extreme volatility into product pricing. Research indicates that the uncertainty created by rapid tariff changes depresses overall economic activity and employment by increasing input costs and hindering investment, making reliable hiring forecasts impossible. |

|

This is creating a down-funnel ripple effect on the global employment market, forcing entire supply chains to put a pause on new hires and strategic expansion. Ultimately, if there is a long term benefit to the tariff rollercoaster, the short-term damage will cloud any foreseeable long-term gains. The combination of these market factors suggest that the unemployment market is headed into even darker waters without a clear path forward on how employers will project and meet business objectives – with TA as a domino in the overall cascade of market impacts. While this should be a uniquely US phenomenon, the global impact is already present. The New Recruiting MathThe combined effect of economic caution and data scarcity is creating a volatile Recruiting Math problem: JOB OPENINGS ^ + UNEMPLOYMENT ^ = MORE RESUMES PER OPEN ROLE As job openings decrease and unemployment rises, the number of applications per open role is surging. Simultaneously, many companies are reducing recruiter headcount. This perfect storm is overwhelming Applicant Tracking Systems (ATS) and human screeners alike, creating a market friction that slows hiring across the board. The AI Authenticity Crisis: AI-to-AI WarfareThe single biggest force driving immediate change remains Artificial Intelligence, but we are entering a new, challenging phase: the “AI-to-AI battlefield.” Candidates are now leveraging advanced AI tools and bots to mass apply at scale— as high as 46% of applications — even generating unique, polished resumes, cover letters, and communications to evade early-stage filters. And we are seeing it, with significant increases in bot created applications in the last three months. For recruiters, the dilemma is acute: when an AI-crafted resume is filtered by an AI screening tool, the fundamental question becomes, is any of the data real? The resulting gap between a candidate’s flawless AI-generated application and their actual capabilities is reported to be widening. It begs the question, can traditional recruiting survive? Or as Gerry Crispin eloquently said recently on our Recruiting Roundtable – have we finally met the end of the resume? This crisis of authenticity, where AI is used to optimize against AI, forces a crucial pivot, and one that has to happen fast. Companies looking to accelerate AI adoption, can’t simply go out and buy an AI. They must first contemplate governance, compliance, process, education and adoption. That starts with understanding how the AI will work inside your organization and how your teams will adopt and monitor the usage and outcomes. The primary question for every TA leader is this: Is the recruiter role fundamentally changing to be a critical evaluator and auditor of AI decision-making? Experts suggest the recruiting role evolve from end to end recruiting to a strategic role focused on human judgment, relationship building, and ethical oversight of algorithmic processes. The combination of regulatory flux, data scarcity, and a technological arms race demands vigilance. In this issue, we dive into what these developments mean for your strategy in the final quarter. Vendor Disruption & Resource Strain ⚠️The slowdown in the labor market is causing major job platforms to rapidly change their business models, creating additional, unexpected pressure on already under-resourced talent teams.

Can’t wait to see. |